Debt is a powerful word. It leaves you with stress and

sweat. It makes your life miserable and gives you a nasty scar. It follows you

like a shadow of a haunted witch, provoking you in your sleep. In short, it all

the way acts like a blood-sucking fly until it squishes and drains whole blood

from your body. So, it is better to stay hundreds and thousands of kilometers

away from it. Save yourself from this cruel swamp, otherwise, you will keep

indulging in it more without even knowing.

The new statistic shows that many Canada Property owners are drowning in debts. If you in your pure oblivion have

sunk yourself into a debt of someone, kindly start paying it off because it

becomes even worse when you leave it for the next day. It is okay if you have

encountered such problem. The things will go in their regular courses after you

undo the debts. It all requires your little energy and lowering your expenses.

It won’t make you poor if you cut down your expenses for some period of time.

For your better and carefree life, follows these simple and easy 10 tips to get

rid of your debts. (The non-debtors can also read for future prevalence.)

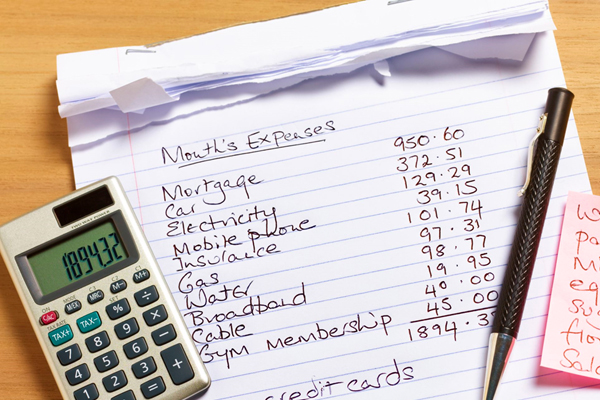

The foremost thing to start

initializing is to make a monthly spreadsheet of your spending and earnings ratios.

Some experts have described it as a powerful tool in getting rid of debts and

getting a full control over your expenses and finances. Start, from now,

preparing a spreadsheet for your weekly expenses and if not possible than a

monthly spreadsheet would be fine. Enrolling in it every single penny you spend

throughout the month. This ensures a check and balance statement for your

finances.

Your duty after making yourself a

debtor is to control yourself from getting into more debts. It is a common act

of debtors that they keep on increasing their debt having in mind that they

soon overcome it. But in actual practice, just opposite of it happens. You

should promise yourself that from now onwards, you won’t add up more money in

your debt list, make a very little use of your credit cards, and never extend

your hands in front of anyone for money. And if you are a student and worry

about your debt payments, seek help from government programs that ensure that

no one would aggravate you until you get on your feet.

It is good to save money for any

future emergency, even during the debt payment. Make yourself penny-wise, it

will definitely help you to protect yourself from experiencing new debts.

Problems come uninvited so it’s better to work out for the bad times.

As though debt leave you with nothing

but a big heartache, never dislodge yourself from the basic needs of life.

Don’t spoil yourself with deprivation and impoverishment. This is your life and

you need to live it to the fullest. Be happy and energetic as being sad and

half-hearted won’t pay off your debt quickly. Eat healthy foods and stay

nourished. Everybody wants a good home and good lifestyle. These things can be

achieved a little late, your first priority should be to undo your debts. Keep

in mind that it’s better to have some time on getting rid of debts than to lead

a depressed life forever.

Luxury doesn’t always mean to own

a new Mercedes-Benz or an extravagant mortgage. The feeling can be possessed by

little things too. And when you are a debtor, don’t run for luxury, at least

not now, until you are debt-free. Don’t rush for expensive spa and salon for

manicure, pedicure, and hairdos. Try them at a discounted price. Move to an

introductory yoga class. Go library for only newspaper reading. Take part in

online contests to win a movie ticket, etc. Break your heart for some time and

go for cheaper things. If you are up renovating

your home, keep it simple and do think about how you will fulfill the expenses.

In this fashion and technological

era, people have forgotten the simple pleasure of life. They run for latest

handbags, dress prints, gadgets, and can spend thousands of dollars on such

items, but won’t buy things like books that hardly require any large expenses.

If you want to pay a debt on time, try seeking new experiences and practice

rather make your bank account left with no money. The experts advised doing some

activities which are cheap or might be free and surely bring much joy and

happiness to your healthy body and soul. This includes; reading books,

listening to a radio, hiking, biking, cooking, long walks, spending time with

family and friends. These activities not only provide you full fitness but also

help you save money to pay the debts. The plus point is that buying less turns

the environment less polluted.

Whenever we confront any problem,

what we do? We just start wasting our money, thinking that money would buy us

happiness and a problem-free life. Experts advised not to spend money on

useless things, start communicating and solve your problems from yourself only.

Don’t put a tag on your face showing that you are very downtrodden. Instead,

seek help from within yourself. You can also communicate with the one you

trust, you never know in whom words you find a solution. Save your money

because it is not a thing that grows on trees, it is obtained through hours and

hours of hard work and efforts.

It is better to share than to buy

and when you are already burdened with debts, this is the positive point. And

when Canada is so blessed with various attractive sharing services, you can

easily save your maximum bucks through sharing, not buying. Being offered to

get a car sharing or a ride to your spot. Sharing can also protect you from the

problems that accompany with your accessories and belongings like owning a

vehicle also need a gas intake, parking, and insurance. So, save yourself from

such problems and pay your debt with no trouble.

Trading is another way to save

money. There are many apps and websites that provide bartering and transaction.

Some websites also provide free repairing of items. You just have to make a

good use of your laptop and internet. Feel free to barter. The strong point is

giving can make you feel great. Give away things you no longer use or you don’t

like. Perhaps, it may be a dress that doesn’t suit you or a grinder you hardly

make use of. Don’t feel ashamed, you are doing exactly fine.

Actually, this is a very great

way to earn money, apart from just saving money. If you have some hidden talent

or you long for something to do or you have some amazing passion. Don’t waste

time, make your passion a profession. If you like writing on a specific topic

for example traveling, then start doing it now. If you love to read, start

reviewing the books. If you like painting, start selling it. If not very big,

at least it would make a difference. Make your dream a reality without any high

expenses.

What do you think guys? Aren’t

they really easy and simple ways? Make your life balance and systemic in all

the way possible, be it your personal, professional, or educational life. Happy

living a stress-free life!

Subscribe our page MKTLIST

to receive weekly blog newsletter.

Be the first to Comment