The unexpected facts had been noticed about the income taxes that one earning person in a family with two children is 12 times far greater as compared to the tax rate given by the same type of family living in Canada.

The OECD conducted a new statistic in response to the idea assumed by the people of Canada that they give a tremendous amount of tax allowances than the people of America, this fact, although, not considers as a true statement.

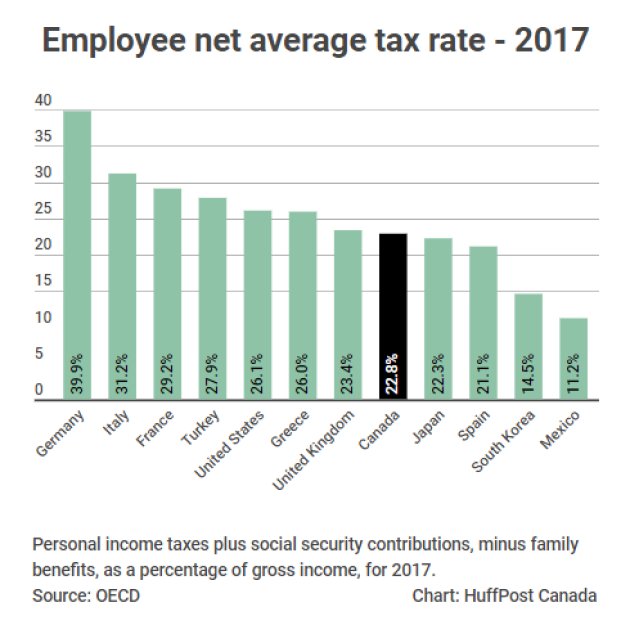

The study investigated by OECD to show “TAXING WAGES 2018”. In 2017, it was observed that the income tax for every individual person living in Canada and having no children was 22.8%, placing Canada on the 11th number out of 35 countries surveyed by OECD. The U.S stood with 26.1%.

The OECD evaluated in terms of the communal and experimental or state taxes, and also with the social security and money-returned policies for the benefits and prosperity of families.

The main divergence has been made with the interest provided by the Liberals for Family’s children.

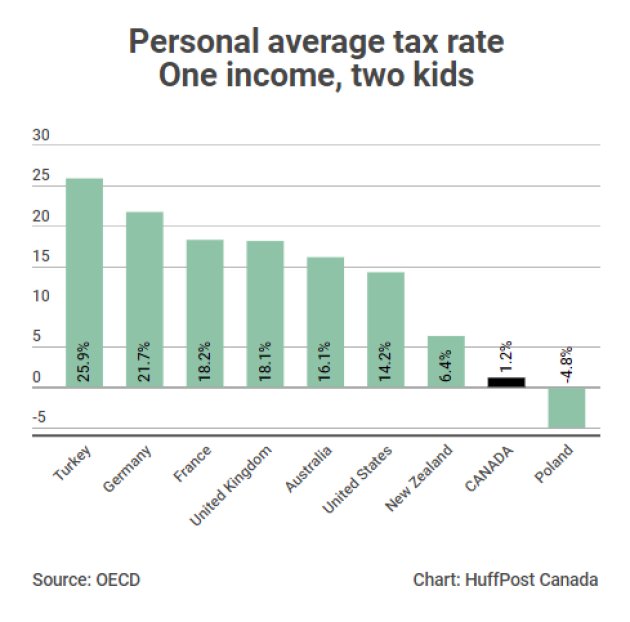

"The employee net average tax rate for an average married worker with two children in Canada was reduced to 1.2 percent in 2017, which is the 32nd lowest in the OECD," the report noted.

One worker in a family with 2 children can now be left with 98.8% gross income. The trend has been set in the U.S that each family has to pay 14.2% tax, and this reward is 12 times greater than in Canada.

It is worth mentioning here that the higher-income families pay a very little payment, children benefits depend on income, while the lower-income families pay less tax with a huge number of children benefits.

In 2000, it was noticed that the Canadian families of one bread owner with 2 children have to pay only 23.1% as compared to the U.S where only 21.2% was needed.

The universal Healthcare system is one of the examples in Canada to show that people earns more value for money in response to their taxes than Americans.

The Canadian business corporation has been disturbed that their collective tax rate is no more competitive with the U.S. But people can carry on with their dignity in their personal tax rates as all over the world it has been highlighted that Canada’s greater tax rate has been assassinated.

Keep rolling with MKTLIST.

Let's celebrate Canada's 151st freedom anniversary, let's help the underprivileged! Share your heart-loved story to show that Canadians belonging to any community, ethnicity, religion, race or city are united for the one single cause i.e. #ICARE.

Visit our link for showing support to the cause: https://www.mktlist.ca/icare

Be the first to Comment